Imagine.

Engineer.

Scale.

Modern, digital-native credit card platform to deliver higher engagement and ROI for banks

Book a Demo

Smart Engage

Boost customer loyalty and drive spends with our powerful engagement platform.

Automated Portfolio Management

One-stop platform from partner integrations to user experiences.

Hyper-personalisation Tools

Real-time user cohort management and nudges with offer automations.

APIs to Deliver Customer Delight

Developer-friendly granular APIs with advanced features like milestone tracking to engage users at scale.

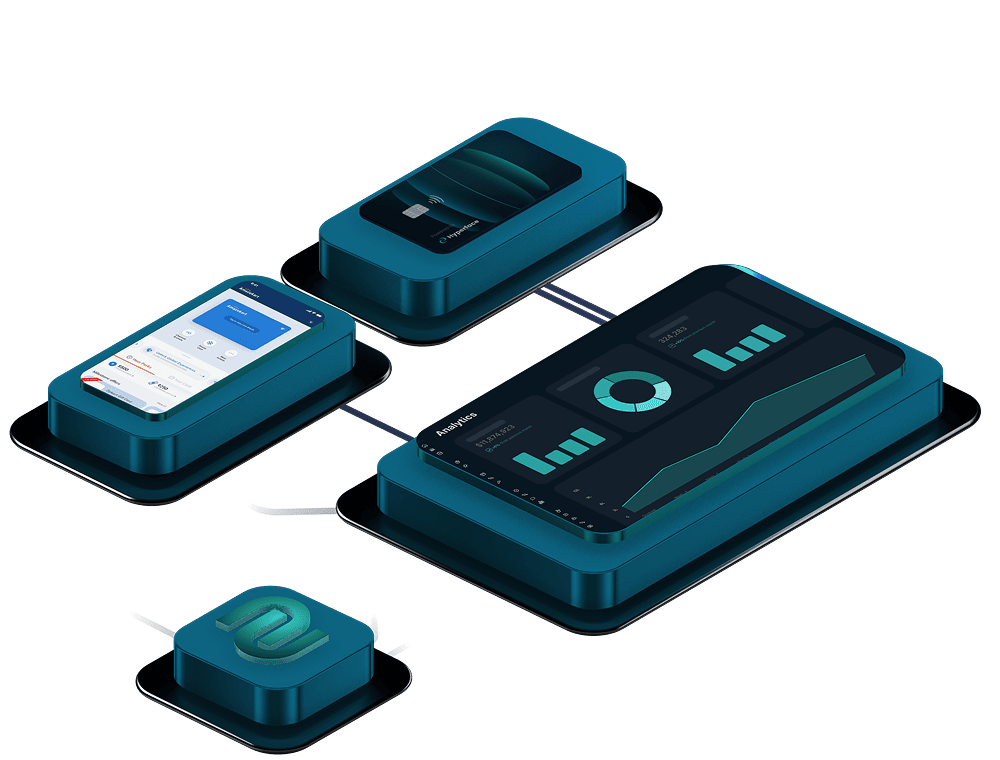

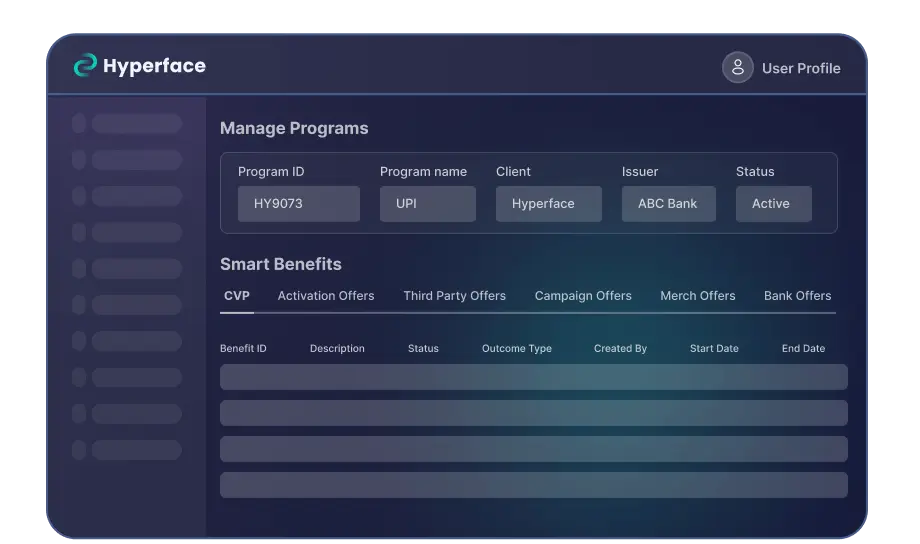

Unified Customer Lifecycle Platform

Unified dashboard to manage customer lifecycle – from program configurations to analytics.

Credit Pro

A comprehensive, digitally intuitive credit engine that allows you to design, configure and manage your credit lines including UPI.

Credit Line on UPI

Design the credit line product of your choice from cards to pay later.

Pick & Choose Modules

Pick and choose from 16+ core banking modules from billing frequency to APRs.

Integrated Partners

Modular backend integrations that align with your existing stack and partnerships.

Streamlined Transactions

Transaction credit simplified with a modular and configurable engine.

Embed Next

Launch powerful co-branded credit card programs in weeks, not months. We handle the complexities of regulations, APIs and workflows – to give you a faster, smoother path to launching.

Future-Ready Experiences

Modern embedded experience for Modern brands.

Seamless Integration

Our co-branded wrapper integrates seamlessly with bank APIs so that brands don’t have to build from scratch.

Speedy GTM with ready SDKs and PWA

Powerful engine for launching customer centric programs faster.

Secure & Compliant

Built for the highest compliance and data security standards.

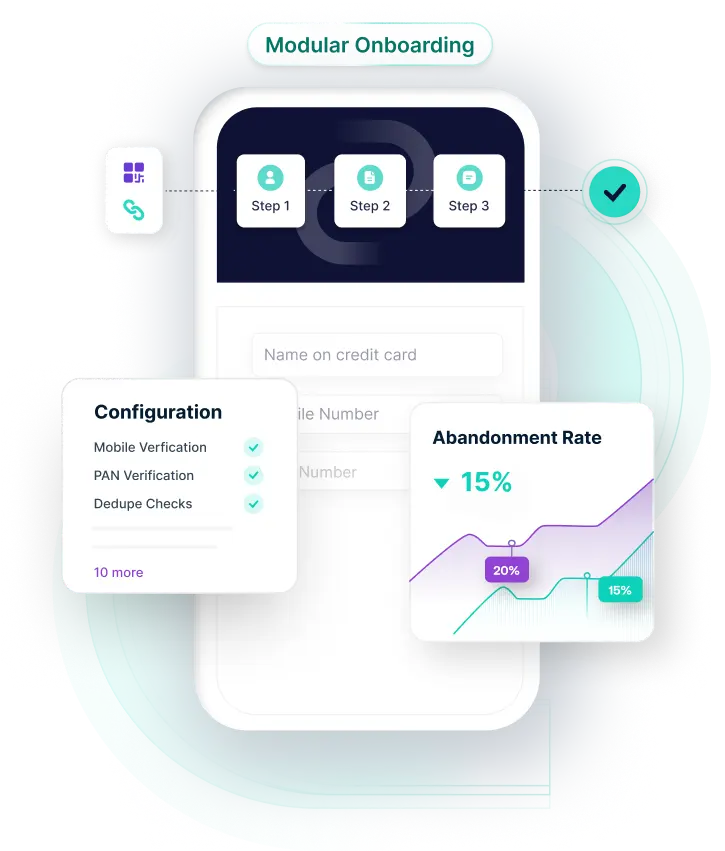

Onboard IQ

Achieve a seamless credit card origination process within your app to customise user journeys , boost conversion rates and enhance customer experience.

Unified Control Center

Flexible and modular integrations from KYC to underwriting.

Create Optimized Workflows

Ready workflows to experiment & optimise conversions.

Custom User Journeys

Configurable backend for building custom journeys.

Track Leads

Simplified lead tracking and analytics.

Why Partner with Hyperface?

The best brands and the sharpest credit card experts trust us. Here’s why.

Curated solutions for the big problems of the industry.

We bring deep subject matter expertise to deliver your business needs.

We go bottom up in problem solving to build top-notch solutions.

We are the originals. Hyperface is Asia’s First ‘Credit Cards as a Service’ platform.

Compliance is our credo and defines all our actions.

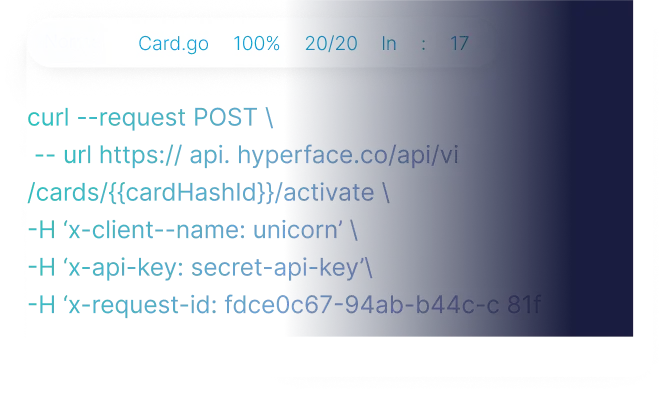

Swift, seamless API and SDKs implementation.

Compliance-first Innovation stack

At Hyperface, compliance is built into the platform. The configurable, future-ready architecture supports continuous alignment with evolving regulatory requirements, helping teams stay compliant while staying ahead of the curve. This foundation is underpinned by comprehensive CBOMs and SBOMs in accepted standards such as SPDX and CycloneDX for enhanced software visibility, traceability and end-to-end compliance.

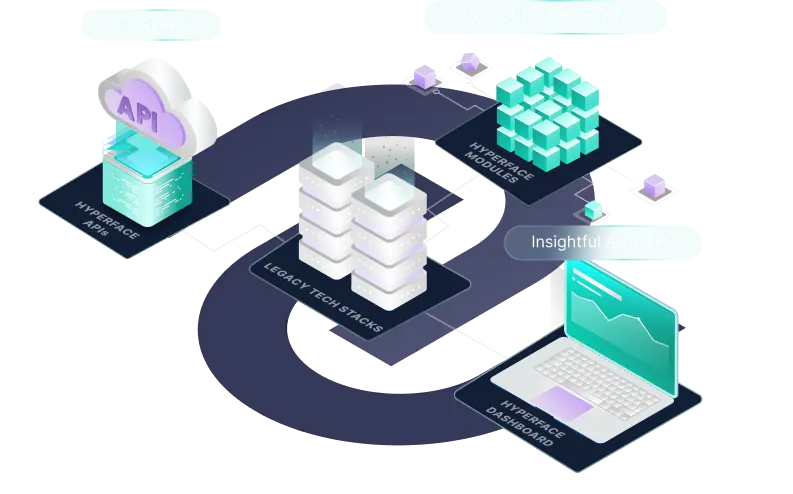

Modular Stack Built to Scale

With modular technology, Hyperface provides flexibility and faster go-to-market and works synchronously with your current architecture to simplify your customer’s card lifecycle.

Hyperface features pre-integrated APIs and SDKs for banks and partner integration with highly customized progressive web app (PWA) to match your brand identity and build superior digital-first customer experiences.

View APIs

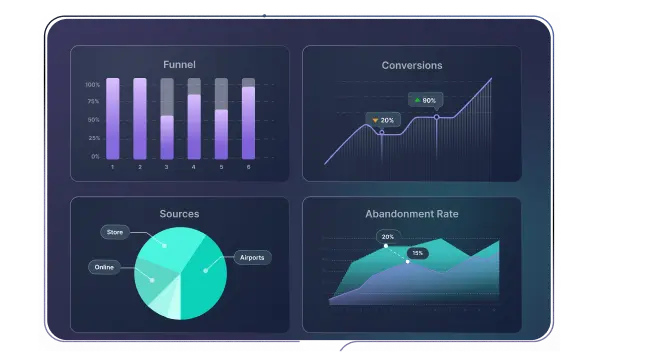

Single-window dashboard for powerful data analytics to optimize program outcomes with features like dynamic tagging of cohorts, spend categorization and real-time reports.

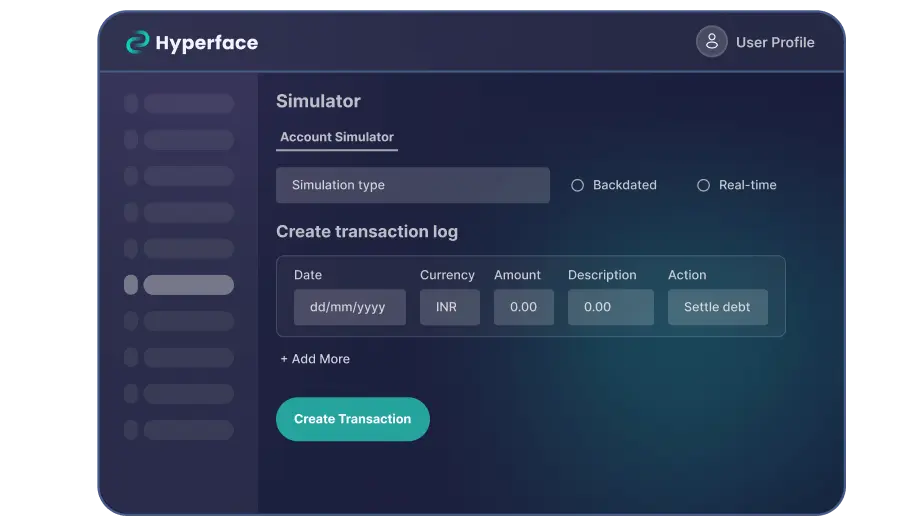

Build and test apps with Sandbox access.

Simulators for credit card transactions, payments, statements, delinquencies and credit life-cycle.

Effortless Card Innovation with Hyperface.

Hyperface is your partner through launch and beyond. Let’s connect and discuss the perfect solution for your business.

Get Started