About Us

Building the Future of Credit Cards Technology

We are making a complex industry more accessible through specialisation and attention to detail.

The Hyperface Story

Hyperface was born out of our shared vision to redefine customer experiences by reimagining the very foundation of credit card technology.

We envision a world where user experiences are intuitive and inclusive, delivered through our powerful platforms.Technology is at the heart of our mission and we are dedicated to unlocking its power to build the most advanced and modern banking platform.

We empower banks to deliver exceptional, digital-first card experiences that resonate deeply with modern consumers through 360° credit card solutions.

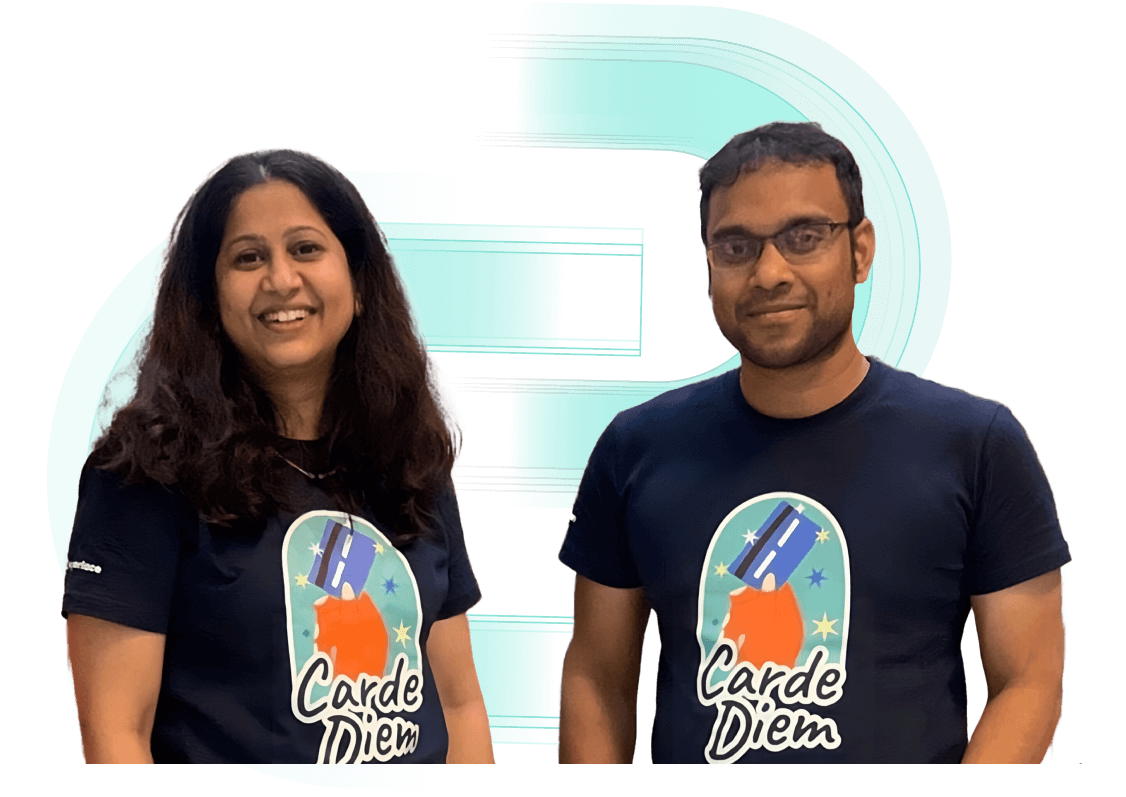

Meet Our Founders

Passionate engineer-turned-entrepreneur and technology visionary, Ramanathan R.V. has played a pivotal role in the payment revolution of the last decade. After building deep engineering solutions at companies like Bankbazaar and Amazon India, he co-founded and served as CTO at Juspay. Ramanathan brings extensive expertise in implementing cutting-edge payment technologies, including building India’s first UPI app, BHIM.

A veteran digital banker, Aishwarya has a track record of disruptive product development and scaling. She has played key roles in digital transformation success stories at banks like Kotak Mahindra and HSBC India. Credited with India’s first fully digitally reimagined savings account (Kotak 811), Aishwarya’s core experience lies in digitally reimagining banking products with strong adherence to regulatory and risk requirements.

Awards and Recognition

Effortless Card Innovation with Hyperface.

Hyperface is your partner through launch and beyond. Let’s connect and discuss the perfect solution for your business.

Get Started