Credit Cards on UPI

On June 8, last year, RBI proposed the linking of credit cards with UPI. Subsequently, at the Global Fintech Fest in Mumbai, the National Payments Corporation of India (NPCI), the retail payments body that runs UPI, announced payments using RuPay credit cards on UPI as one of the key initiatives to revolutionise digital payments.

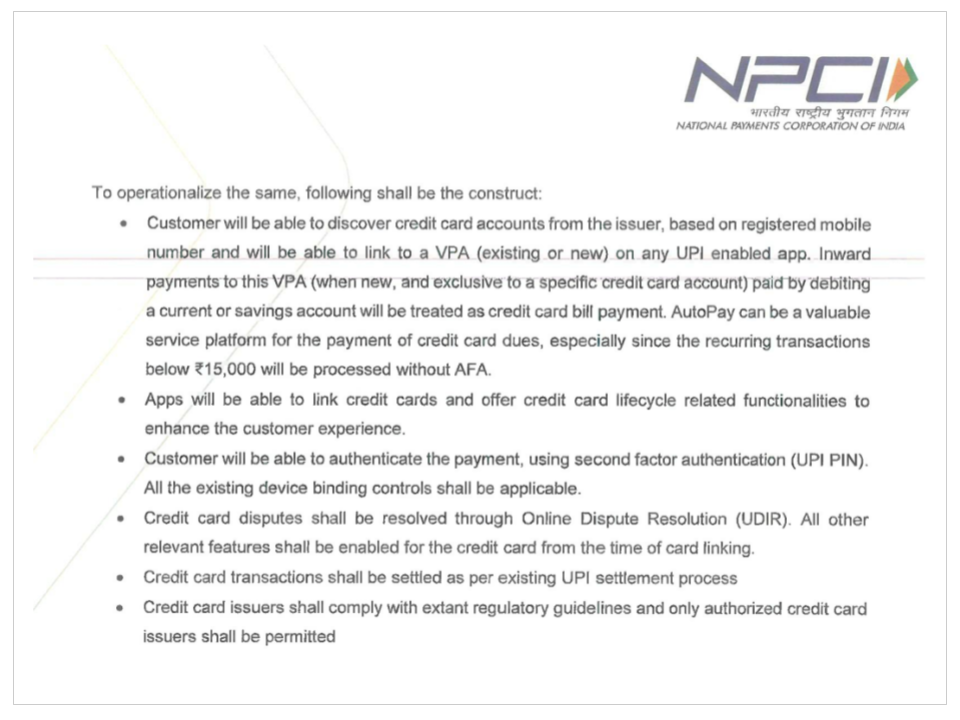

While the RBI stated the objective of linking the RuPay credit cards with UPI, they had left out the finer details of the what and how. The recent NPCI’s operating circular of Dec 7, 2022 spells out important details for RuPay Credit Cards linked to UPI.

Here are the key extracts from the circular:

The key point above is that users will be able to link credit cards in their UPI app. Another key highlight of the circular is that users shall be able to do much more with their credit card on their UPI itself.

The familiarity and ease of UPI with the convenience of credit can significantly increase credit card usage across India. However, it can also change how credit cards are distributed in the country. Fintech companies are likely to play a crucial role in the growth of Credit Cards on UPI.

With the ability to add a credit card to your favourite UPI app can significantly improve the usage of credit cards.

Let’s take a sneak peek into the future and see some key changes that could happen with Credit Cards on UPI.

Exponential Increase in Acceptance

Payments ecosystem has two sides – issuance and acceptance. In a country like India, where the merchants are extremely cost-conscious, it is almost a given that POS terminals which are very expensive will find less takers. On the contrary, a QR code sticker costs less than 5 rupees. UPI embraced the QR code as the acceptance means and found ready uptake. This is evident in the statistics. In Nov, 2022, there were about 7.3 million POS terminals versus about 230 million UPI QR codes!

If a credit card can be linked to pay with UPI, then acceptance now grows to 230 million points in a single stroke. UPI is spreading in our country like wildfire, and with it, credit cards can now get accepted across the length and breadth of the nation.

We believe that customers will be more than glad to link their credit cards to the UPI app and pay from it (as opposed to their Savings Bank Account) since they benefit from the interest free days. Small merchants have nothing to complain since they continue to benefit from the Zero MDR regime.

With all the incentives aligning well, this should see an explosion in the number of transactions.

Digital Servicing for Credit Cards via UPI

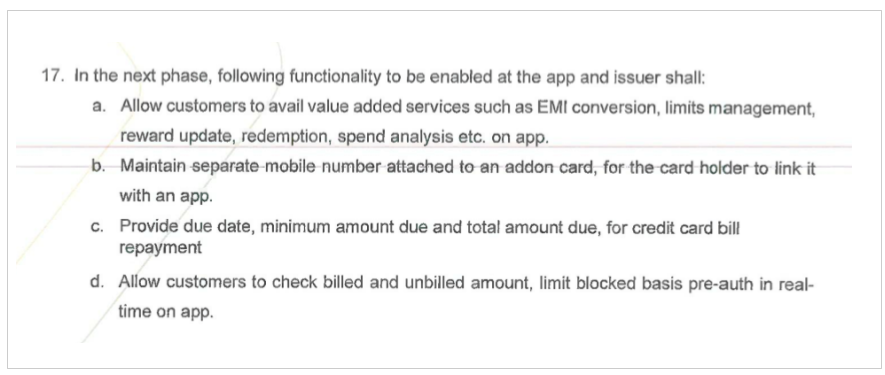

The circular from NPCI doesn’t stop at enabling credit card transactions via UPI QR.

The circular essentially informs us that credit card servicing will be offered by UPI apps. For a bank that is issuing credit cards but lacking digital adoption amongst its customers, this is a godsend. Most banks have always struggled with getting their customers to download the mobile banking app. On the other hand, users have readily embraced UPI apps (for a variety of reasons).

With this guidance, the front-end experience could be driven by UPI Apps. We believe that the list of features covered under this arrangement will expand in the future. At some point, the majority of card life cycle management functionalities could be offered by UPI apps without having to integrate deeply with the bank.

With the inevitable rollout of Account Aggregators, UPI apps can fetch credit cards transaction data (which will eventually be covered under AA) to provide more features to customers. It wouldn’t be far-fetched to say that with this mandate, a UPI app can provide all the important functionalities that a mobile banking app will provide for credit card management.

Commercial Incentive to Promote Credit Cards on UPI

NPCI has proposed a revenue share of 4bps (0.04%) to UPI apps and 4bps to PSP bank. This is 4bps more than what is offered for transactions conducted using savings bank account. This commercial incentive will now offer a great opportunity for UPI apps to generate transactional revenues which has been a thorny issue in the UPI ecosystem for UPI apps such as GPay and PhonePe. This incentive will drive the UPI apps to nudge customers to pay using Credit Card as opposed to their Savings Bank account.

We believe that the banks big on the liabilities side (savings bank accounts) will worry the least about this. They will benefit from the reduced load on their core banking systems.

UPI as the Growth Hack for Credit Cards

The other big challenge for any bank today is the increasing customer acquisition cost. UPI apps can become the perfect distribution vehicle for acquiring new customers. UPI Apps could be a much better and more efficient acquisition channel than running search or social ads.

With digital issuance and digital servicing, a bank can reduce the cost of issuance significantly. In our estimate, the issuance cost can drop from 4000 rupees to 400 rupees. In turn, this can be the trigger for issuing credit cards with lower limit.

For instance, if a bank can profitably issue cards with credit limit as low as INR 25,000, that can open up nearly 25% of households in India as a green field market opportunity.

This is also a shot in the arm for smaller banks. With all the key credit card functionalities present in the UPI apps, smaller banks need not worry about investing in providing a digital card experience. They can focus on issuance and let UPI apps power the credit card life cycle management and functionalities.

Summarising Thoughts

Banks now have a great opportunity to issue credit cards to the middle class of India. These new-to-credit customers can now build a rich credit history through Rupay+UPI. It is our belief that this will culminate in increased access to formal credit across the nation.

Over the next 5-10 years, we could see credit cards in India becoming the default payment account on UPI (as opposed to savings bank account). The growing adoption of digital payments will get a further boost with credit cards on UPI and accelerate India towards a cashless economy.