Standalone EMI Conversion for Transactions & Outstanding Balances

By Editorial Team

10th April 2025

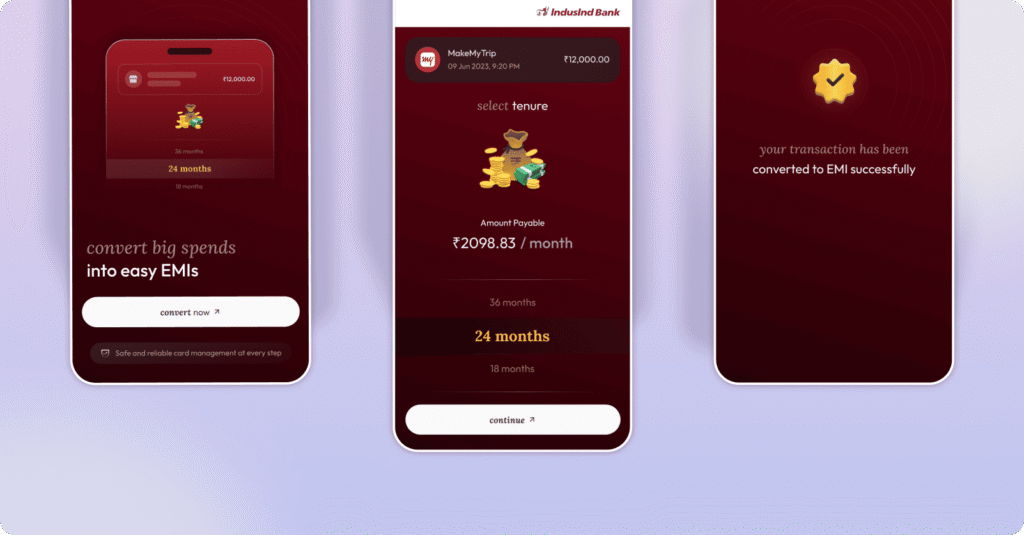

Seamless EMI conversion is now just a click away. This update introduces a fully standalone journey for users to convert transactions and outstanding balances into EMIs—driven by automated communications and real-time insights. Banks can now run highly effective EMI campaigns with minimal effort while ensuring compliance and scalability.

What Does It Solve?

Previously, users had to navigate through banking apps to convert their transactions or outstanding balances into EMIs, leading to low adoption rates. This enhancement eliminates complexity by offering an automated, communication-driven experience, making EMI conversion effortless.

Key Features

- Automated EMI Campaigns – Trigger SMS/Email notifications to eligible users through Hyperface’s communication engine.

- One-Click Access – Users receive a secure, personalized link for instant EMI conversion—no app / net banking home page navigation required.

- Built-in Analytics & Reporting – Track user engagement, optimize campaigns, and boost conversion rates.

- Regulatory & Compliance Ready – Comes with built-in reporting tools to meet compliance requirements.

- Scalable & Versatile – Supports high-volume EMI campaigns across multiple user segments.

Benefits You’ll Love

- Faster EMI Conversions – Users can convert transactions in seconds, enhancing experience and engagement.

- Automated Targeting – Only eligible users receive EMI offers, ensuring higher campaign effectiveness.

- Data-Driven Optimization – Real-time analytics help fine-tune campaigns for better results.

- Effortless Compliance – Built-in tools ensure EMI offerings align with regulatory requirements.

- Rapid Deployment – Banks can now launch EMI campaigns quickly with minimal setup.

Use Cases in Action

For Banks:

- Increase in EMI adoption through automated, targeted campaigns.

- Regulatory Compliance ensures EMI offerings align with legal and operational standards.

For Users:

- High-value transaction users can instantly convert them into EMIs.

- Credit Card Outstanding Balance Management enables users to restructure payments conveniently.

- Regulatory Compliance ensures EMI offerings align with legal and operational standards.

How It Works

- User Eligibility Check – The system identifies eligible transactions or outstanding balances for EMI conversion.

- Automated Communication – SMS/Email is triggered with a secure login link.

- Quick EMI Setup – Users log in, select EMI tenure, and confirm conversion in a few clicks.

- Analytics & Compliance – Banks get detailed reports and insights to refine EMI offerings.

Share this: