The Crucial Role of Technology Partners in delivering Co-branded Credit Card Success

Maya Kunnath, Head of Legal, shares her insights on the pivotal role of technology partners in ensuring co-branded credit card success for e-commerce brands.

E-commerce brands have surged in popularity thanks to their unparalleled convenience, extensive product choices, and seamless shopping experiences. A co-branded credit card, powered by the right technology partner, then becomes a natural progression in the brand journey of the e-commerce brand to deepen customer engagement.

However, In the ever-evolving world of financial services, the collaboration between a bank and an e-commerce brand to launch a co-branded credit card presents an intriguing case study of regulatory navigation. E-commerce brands have brought a new dimension to traditional banking partnerships.

This partnership, blending the bank’s financial acumen with the e-commerce brand’s vast consumer reach, calls for meticulous alignment with a complex web of regulations, to ensure compliance while offering innovative financial products. This becomes critical to the success of the co-branded credit card program.

There are four key dimensions to regulatory compliance in this case.

1. Adherence to Financial Regulations: Bank, as a regulated financial entity, must comply with the Reserve Bank of India’s stringent guidelines. These guidelines encompass consumer protection, lending norms, and financial stability. The bank’s role in this partnership is not just to provide financial services but also to ensure that the partnership adheres to these regulatory requirements.

2. Data Privacy and Security: A critical concern in the co-brand credit card partnership is data privacy. Given the exchange of customer information between a bank and a non-financial entity, the partnership must adhere to laws like India’s Personal Data Protection regulations and international regulations like GDPR for global operations. Safeguarding customer data against breaches is paramount.

3. Marketing and Consumer Representation: The partnership’s marketing strategies must align with legal stipulations to prevent misleading advertisements. It is crucial that the features, benefits, and fees of the co-branded card are transparently communicated to avoid misrepresentation.

4. Consumer Protection Laws: These laws ensure transparent billing practices, fair dispute resolution mechanisms, and protection against fraud. The co-brand card must offer clear terms of service, reasonable fee structures, and robust customer support.

The partnership, navigating through this regulatory maze, highlights the importance of strategic planning and legal compliance in the financial sector. The dynamic nature of financial regulations, especially concerning consumer protection and data privacy, requires ongoing vigilance and adaptation.

Even more so, in recent days, we have witnessed the regulatory landscape for co-branded credit cards in India undergo significant updates, as particularly reflected in the Master Direction on issuance and conduct of debit and credit cards by the Reserve Bank of India (RBI). These regulations are a step towards enhancing the security and privacy of cardholders, ensuring transparency in card issuances, and setting clear boundaries for the roles of both card issuers and co-branding entities. They reflect the RBI’s commitment to consumer protection and data security in the evolving landscape of financial services.

In this scenario, the role of the Technology Service Provider (TSP) such as Hyperface assumes critical importance to help both entities navigate these challenges with ease, launch the program with the least friction, and help build scale, all within the defined guardrails.

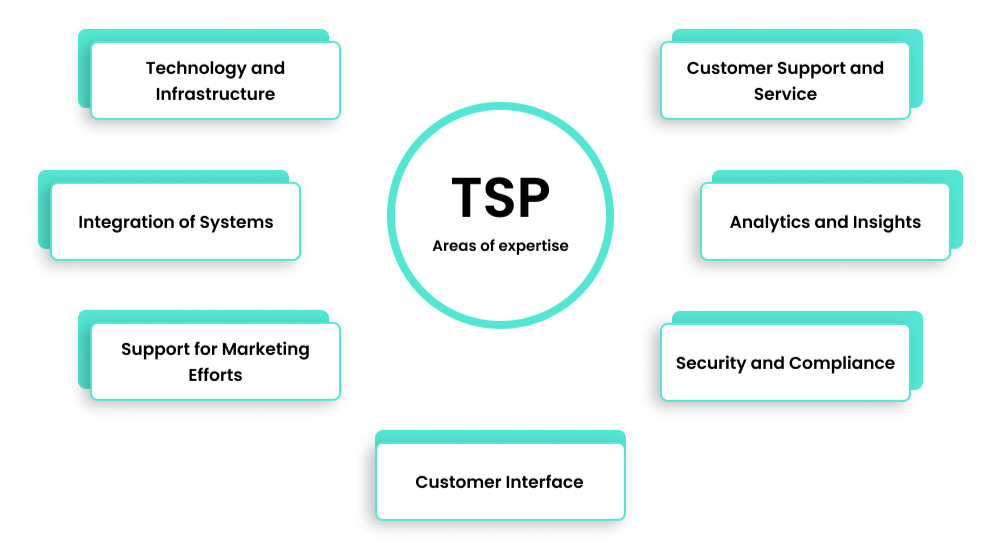

While the specific roles can vary based on the agreement between the bank, the co-brand partner, and the TSP, generally the TSP brings in its expertise in the following areas:

Technology and Infrastructure: TSPs provide the necessary technology infrastructure to support the issuance and functioning of co-branded cards. This includes software for account management, transaction processing, data analytics, and security features.

Integration of Systems: They ensure the seamless integration of the bank’s systems with those of the co-branding partner, facilitating data sharing and transaction processing while adhering to regulatory compliance, particularly in terms of data security and privacy.

Customer Interface: TSPs may develop and maintain customer-facing interfaces such as mobile apps or web portals. These platforms are used by cardholders to manage their accounts, view transactions, redeem rewards, and access customer service.

Security and Compliance: Ensuring the security of transactions and safeguarding customer data is a critical role of TSPs. They must comply with financial regulations, data protection laws, and cybersecurity standards.

Analytics and Insights: TSPs often provide analytical tools and insights derived from transaction data. These analytics can help in understanding customer behavior, tailoring offers, and managing risks.

Support for Marketing Efforts: In some cases, TSPs may also offer tools and support for marketing campaigns, customer acquisition, and loyalty program management, all tailored to the specifics of the co-branding arrangement.

Customer Support and Service: TSPs might also be involved in providing customer support services, including handling queries, troubleshooting, and managing disputes.

In essence, the TSP is a crucial behind-the-scenes player that enables the smooth operation and technological integration necessary for the successful launch and management of a co-branded credit card program. Their role is central to ensuring that the partnership between the financial institution and the co-branding entity operates efficiently, securely, and in compliance with regulatory standards.

At Hyperface, we transcend the role of a technology partner. As ‘The Definitive Credit Cards Innovation Platform’, we provide a comprehensive suite of services from program design and development to technology infrastructure, risk management, and compliance. Hyperface provides everything needed to create, configure, customise, and scale a successful co-brand credit card program.