Brand visibility: Turning everyday swipes into enduring brand reinforcement with co-branded credit cards

As published on https://www.financialexpress.com/business/brandwagon/

In an era dominated by data, the brand-customised credit card is more than just a plastic transaction tool; it’s a personal companion, allowing you to ditch the cookie-cutter experience.

Did you know that your daily caffeine run is probably brewing trust with your favorite coffee shop? Imagine Sheena, a busy professional whose mornings revolve around a perfectly crafted cappuccino from “Warm Bean.” For months, Sheena religiously gets her fix, using her trusty Warm Bean co-branded credit card every time.

The routine extends beyond caffeine—it’s a subconscious dance building trust cup by cup. The familiar barista knows Sheena’s name, her mood, and her coffee preferences. This consistency breeds comfort and trust in the welcoming space.

This subconscious brewing of trust isn’t just a feel-good theory – it translates into real-world results. Many studies have found that consistent brand experiences across touchpoints strengthen a brand’s image, subconsciously influence consumer perceptions, and positively influence purchase decisions. This “mere exposure effect,” as psychologists call it, means the more we see something, the more likely we are to like it, ultimately paving the way for preference and loyalty.

Thus, while you savor that frothy cappuccino, the seemingly insignificant swipes of your trusty coffee shop card are working their magic, weaving the threads of brand loyalty. Each transaction is a brushstroke in shaping brand perception, transforming the logo into a familiar friend who caters to your needs.

Co-Branded Cards vs. Traditional: Elevating the Plastic Experience

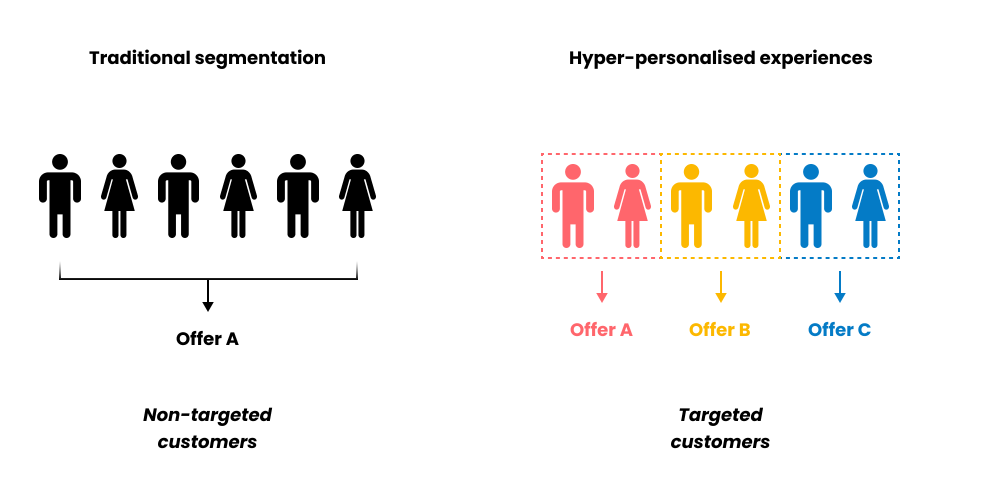

Hence, unlike the standard swipes of traditional cards that offer one-size-fits-all rewards, the swipes from co-branded credit cards unlock a world of targeted rewards, exclusive perks, and elevated experiences tailored to your favorite brands. They turn routine spending into a unique experience that speaks volumes about brand loyalty.

Besides the targeted reward and goodies, the experience includes:

Cutting-edge security safeguards your data, privacy, and finances, fostering trust in the brand partnership with every swipe.

Integration of the co-branded card seamlessly within the partner brand’s app further enhances security through authentication providing a unified brand experience across platforms and adding an extra layer of consistency and trustworthiness to interactions.

Powered virtual cards offer secure online and mobile payments, ideal for exclusive brand experiences like limited-time offers and online events, ensuring a safe and hassle-free transaction process.

Co-Branded Payment Platforms: Digital Wallets and Beyond

The new branded credit card thus emerges as the key to an expansive metaverse, a passport to your favorite brand’s entire ecosystem. Think sleek e-wallets, buzzing digital marketplaces, and loyalty programs that seamlessly blend your online and offline experiences.

You can forget fumbling with card swipes and recalling pins —contactless taps are the new superpower. Every tap, every purchase, fuels your loyalty meter, showering you with speedy rewards without any hassle.

Curating Hyper-Personalised Experiences: Your Card Knows You Best

In an era dominated by data, the brand-customised credit card is more than just a plastic transaction tool; it’s a personal companion, allowing you to ditch the cookie-cutter experience. It highlights exclusive, targeted offers right on your phone as you browse in-store or online. Picture limited-edition drops appearing just in time for your shopping spree. This partnership goes beyond simple spending; it dives deep into your data (the good kind, not the creepy kind!) to craft rewards programs that are like whispered wishes granted. It could be birthday discounts on your favorite perfume, VIP tickets to the band you love, or free upgrades to that beach getaway you’ve been dreaming of. It’s a conversation between you, your brand, and your co-branded card, all designed to make you feel like the star of the show!

And this isn’t just a one-way street. Your data preferences and spending patterns help brands curate and craft programs that are uniquely relevant and exciting for you.

Powered by cutting-edge tech, your co-branded card emerges as a symbol of convenience, security, and endless possibilities, aligning it with forward-thinking brands. Tech-savvy consumers who embrace innovation and seek seamless, futuristic experiences will find it a perfect fit.

In an era marked by digital overload and constant distractions, cultivating brand loyalty is no simple ask. However, co-branded cards emerge as powerful tools with immense potential in this challenging landscape. But simply putting two logos on plastic isn’t enough. For brands seeking loyal advocates, the key lies in crafting co-branded experiences that weave seamlessly into consumers’ digital lives, from onboarding to reaping the rewards.

When done well, the benefits to brands can be significant. Consider Target, a leading US retailer, and its RedCard program. It extends beyond a mere co-branded card, offering a comprehensive rewards structure that caters to diverse needs beyond cashback. Target reveals that RedCard holders are among their most engaged guests, having saved over $9.7 billion over 12 years. These customers accounted for 18.3% of total sales, generating incremental sales of $4.6 billion for the 3 months ending Oct 2023.

The Delta SkyMiles American Express Card targets the loyal customers of Delta Airlines and is tailored to enrich their travel experiences while earning rewards. Delta revealed in June 2023 that spending on Delta co-branded credit cards was nearing 1% of U.S. GDP. These staggering numbers reflect the deep engagement and repeat patronage that is possible by building meaningful card experiences. What’s needed is a shift from transactions to connections, ensuring that each swipe contributes to a meaningful relationship in the ever-evolving digital era. By focusing on this, brands can transform co-branded cards from plastic rectangles into powerful tools that build lasting loyalty by making customers feel valued, understood, and rewarded at every step. Hyperface’s Embed Next empowers brands and banks to launch co-branded credit cards swiftly and efficiently, providing all the tools needed to create, scale, and manage these transformative partnerships.