Changing the Beauty Landscape in India: A Case for Co-branded Credit Cards for Beauty E-Comm Retailers

The Beauty Revolution in India

India’s beauty and personal care market is booming like never before! With a young, dynamic population and increasing digital accessibility, the beauty sector is thriving. From makeup enthusiasts to skincare devotees, the appetite for beauty products is insatiable, creating an ecosystem where brands, businesses, and consumers are more interconnected than ever.

Beauty E-Commerce Brand Value Surge

The rise of e-commerce giants like Nykaa, Purplle, and now Reliance’s Tira, has reshaped the beauty landscape in India. According to IMARC Group, the Indian beauty and personal care market was valued at USD 15 billion in 2022 and is expected to grow at a CAGR of 8.1% from 2023 to 2028. This growth is attributed to increased internet accessibility, a growing middle-class population, and the influence of social media. The Hindu Publication reports that the market could grow by 40% by 2026. The buzz around beauty has never been louder!

As consumers become more brand-conscious and quality-focused, the beauty e-commerce sector presents a great opportunity for innovative financial products like co-branded credit cards in India.

The Online Shopping Explosion

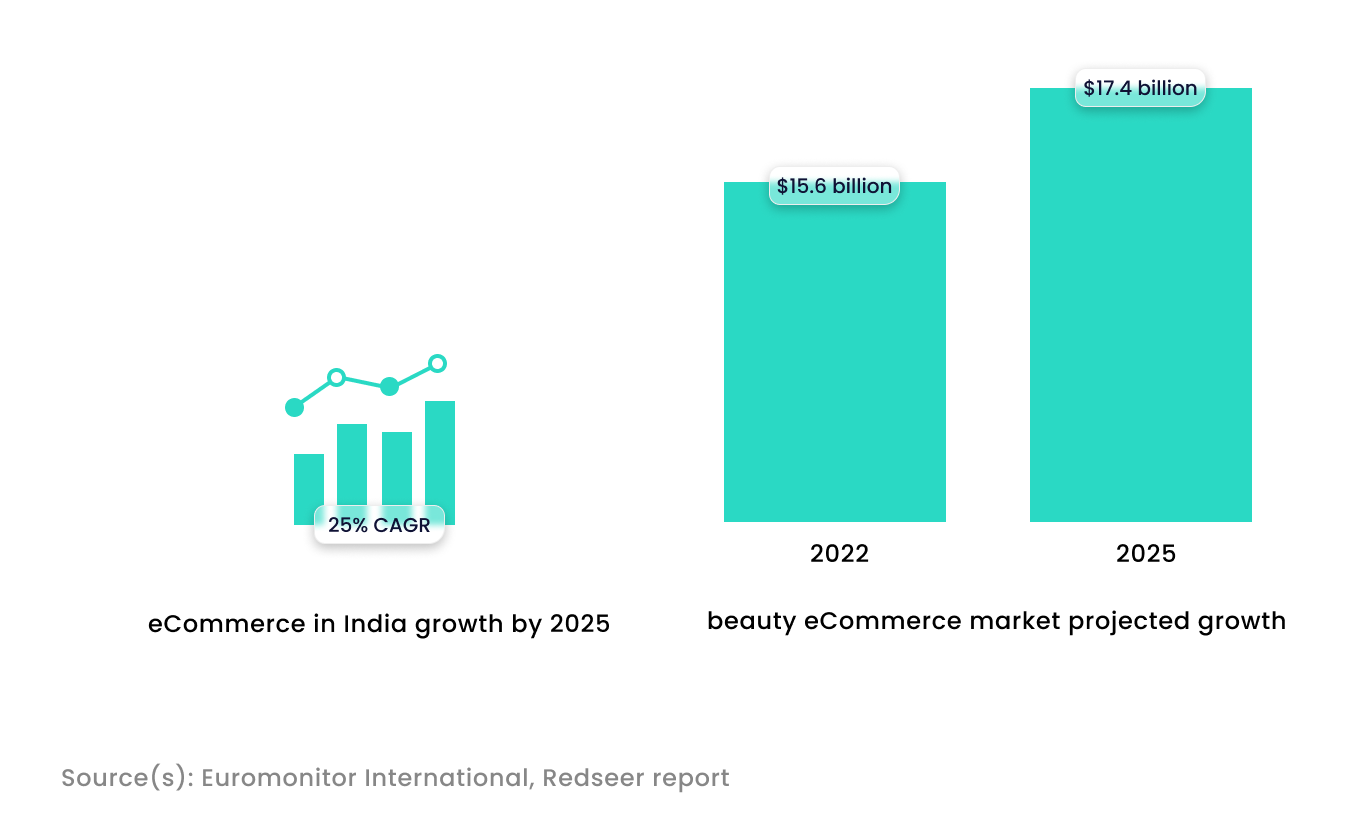

The beauty e-commerce sector has seen a dramatic increase in user engagement and spending. Platforms like Nykaa and Purplle have reported substantial growth in both daily active users and average order values. According to a Redseer report, by 2025, eCommerce in India will grow at a CAGR of 25%. Not just this, the beauty eCommerce market is projected to reach $17.4 billion by 2025 from $15.6 billion in 2022 as per a report by Euromonitor International. This surge in demand opens up unique opportunities for co-branded credit cards, which can offer tailored rewards and benefits that resonate with beauty enthusiasts across the country.

The Magic of Co-branded Credit Cards with Your Favourite Beauty E-Retailers

Imagine a credit card that offers exclusive rewards, discounts, and cashback specifically designed for beauty lovers like you and that too for your favourite beauty brands. Drawing inspiration from successful global examples, such as:

Sephora Visa Credit Card (USA):

This card offers rewards for every dollar spent, both at Sephora and elsewhere, including 4% back in rewards on Sephora purchases, 2% on dining and groceries, and 1% on all other purchases.

Ulta Beauty Mastercard (USA):

This card allows cardholders to earn 2 points for every dollar spent at Ulta Beauty and 1 point for every dollar spent everywhere else, which can be redeemed for beauty products and services.

These examples illustrate how co-branded credit cards can transform the online beauty shopping experience by offering benefits that lead to higher customer spend, improved retention, and increased frequency of purchases, thereby enhancing customer loyalty and engagement.

Seizing the Opportunity

For banks and beauty e-commerce retailers, combining beauty and financial services is a chance to meet the needs of beauty enthusiasts across India through co-branded credit cards.

The Next Big Thing in Beauty Shopping

As the Online e-commerce beauty market continues to thrive, now is the time for bold initiatives. A co-branded credit card for your favourite beauty e-retailer could be the next big thing, offering great rewards and connecting with beauty lovers nationwide.

Embed Next: The Proprietary Hyperface Co-branded Credit Cards Module

Hyperface partners with brands and banks to launch co-branded credit cards in weeks instead of months, all while ensuring strict regulatory compliance. Ready to take your customer engagement to the next level? Reach out to us and let’s make it happen!