Looking Beyond the Interchange

Card issuing companies have grown multi-fold in the past few years, and firms such as Brex & Chime have grown even faster.

In the east, firms such as Aspire have issued hundreds of thousands of cards. This phenomenon is catching on even in India, where UPI heavily dominates, and Fintech companies in India offer cards across the spectrum catering to multiple use cases – credit cards, secured cards, prepaid cards, forex cards, etc.

There has been an uptick in the number of companies offering cards to consumers, like OneCard, which provides credit cards, Zaggle, which offers Prepaid Cards and other fintech companies like Slice, Uni Cards, Niyo Global, Mool, BookMyForex and many more.

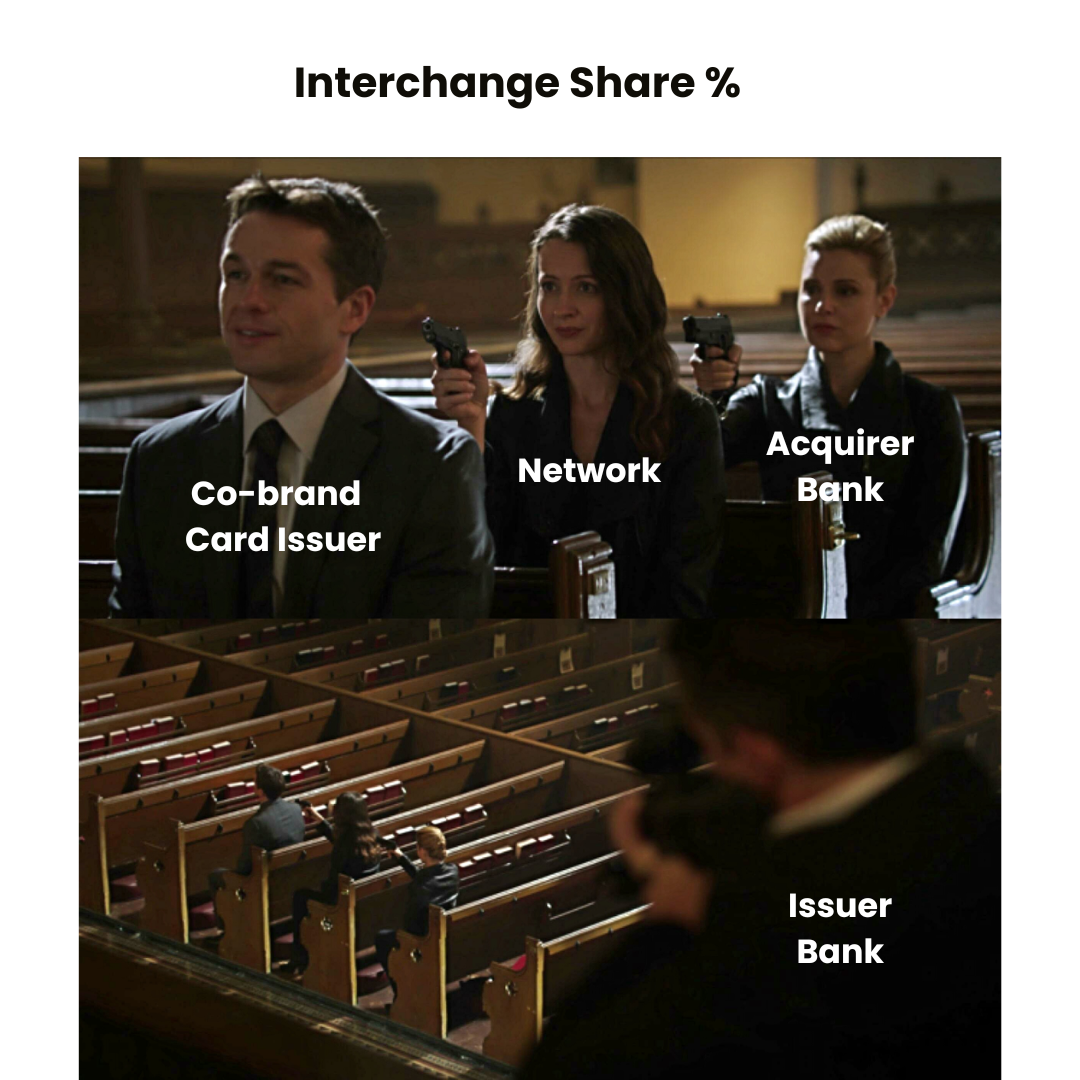

Traditionally, card issuing companies heavily rely on income arising from the interchange as a percentage share.

What is interchange? The card network charges an interchange fee to the acquirer, which the acquirers pass on to the merchant. The network shares most of this income with the card issuer. This attractive revenue drives many fintech and even non-fintech companies to issue cards. Interchange in North America (particularly in the USA) is much higher than in most other geographies.

However, by adding more intermediaries like card switch providers and BaaS providers that make issuing easy, the interchange-based revenue share has diminished.

Recently, Matrix Partners published an article titled “Interchange is a burning platform” that highlights the challenge of focussing on interchange revenue. The article is available here – https://matrix.vc/viewpoints/interchange-is-a-burning-platform.

Here are a few excerpts from the article that card issuers should take note of:

Excerpt 1: Interchange – and particularly debit interchange – itself was never meant to support multiple large businesses

Excerpt 2: It’s worth reiterating that even if card fee pools remain as they are today and don’t shrink, they’re still a bad place to build a venture-scale business. While there are several interesting reasons why these pools might shrink, it’s beyond the scope of this post to explore those in depth.

We can’t agree more with the above article that the economics of card issuance solely based on interchange is a very bad idea. There are myriad of ways to leverage the card program beyond the interchange that can help the co-brand issuer to generate better revenue and improve the ROI. We will look at some of the important ones here:

Usage Fee

Various fees applied on cards could be a good source of revenue apart from the interchange. Joining fees, annual fees, cash advance fees (ATM withdrawals), and late payment fees are popular on cards.

In India, there is usually an annual fee for cards that offer very attractive cashback. These fees tend to get waived off upon the user meeting a given spend limit. And there are definitely yearly fees for premium cards with excellent benefits.

Alternatively, the issuer can consider a fee for activating certain features. For instance, the AU LIT credit card by AU Small Finance Bank is India’s first customisable card is an innovative lifetime free credit card whereby a user could pay a nominal fee to select a benefit every quarter.

In the case of prepaid cards, some card issuers levy a maintenance fee if the customer has been inactive for a specific period, e.g. 90 days.

EMI Processing Fees

37% of the credit card receivables of SBI Cards in Q3 FY 2023 were in EMIs, which implies the strong role of EMIs in the credit card business.

The co-brand card issuer can make revenue through this source by levying EMI processing fees that can be charged upfront at the time of converting the transaction into EMIs.

Offer Cross-sell

Driving footfall is the key challenge of all consumer businesses. This is true for both online and offline businesses. Card issuers can leverage their franchisee to cross-sell offers from these consumer businesses for a fee. Consumer businesses in hospitality, dining, fashion, health, etc tend to have higher margins (north of 30%), thus giving them the headroom to give offers to customers. By driving footfalls to these businesses, card issuers can charge a fee to these businesses.

This tends to work better in categories that compliment each other. For instance, a flight booking company can sign up with a ride-hailing company for a cross-promotional offer. A wealth tech app can tie up with an ed-tech company for promoting educational courses.

The key is to have a mechanism for attribution. Hyperface solves this challenge by tracking the card usage end to end from a single dashboard.

Issue Metal/Designer Card

A designer or metal card is a significant differentiation in today’s plastic card world. Designer cards are perceived to be a status symbol of wealth and exclusivity, and metal cards not only project a premium image but also help the card issuer generate revenue.

OneCard is a classic example where it charges issuance fees for add-on cardholders for metal cards. The company also charges card re-issuance fees for replacement cards.

Imagine having a photo of your pet on your credit card. Here’s a great example of how Wells Fargo allows you to customise your card with your photos – link. This kind of personalisation helps in creating a deeper relationship with cardholders. Customers have shown great enthusiasm for such personalised offerings and it becomes a great way to generate revenue for the issuers.

Selling Gift Vouchers

India’s Gift Card Market is estimated to be USD 39.21 Bn in 2022 and slated to grow at 20% in the coming years. One of the main things driving the growth of the gift card market in India is the accelerated growth of e-commerce. Customers in India have shown tremendous enthusiasm to purchase Gift vouchers that can be redeemed at destinations such as Amazon, Croma, Lifestyle, Flipkart, Swiggy, Titan, Nike, Landmark, etc.

Card issuers can procure the gift vouchers in bulk. These gift vouchers typically carry a reasonably good margin. Outside of the top brands, the margins tend to increase dramatically. Card issuers can directly sell gift vouchers in their app to their users. Paytm and Amazon have done this splendidly well in India.

Beyond selling the gift vouchers directly, card issuers can also create gamified experiences. They can run creative campaigns such as “Spend ₹10,000 in the next 30 days and win a ₹200 gift voucher of Biergarten”.

Selling Subscriptions

Selling subscription services could be another good source of revenue for you. You’ve worked hard to build an audience for your card, so why not monetize it by helping other service providers reach them through your card.

For example, you could offer magazine and OTT subscriptions through your card and earn a commission for each sale. Customers could set up autopay through your card, which will help in recurring revenue for the service provider.

If your audience is female-skewed, you tie up with a leading salon company and offer their subscription packages to your customers.

Display Offers & Advertising

You can create premium advertising space in your embedded card experience and charge advertisers to display their ads to your cardholders. You could customise the ads as per audience cohorts and have multiple advertisers on your platforms run ads simultaneously, helping you create a new scalable revenue line.

For example, you could have a travel company showing ads to a cohort of your users who spent a lot on travel in the last 6 months. You could have an online food ordering app company advertising its offers for another cohort of your users who frequently spend on restaurants.

Cross-sell Bank Products

Let’s stop racking our brains further. Why not cross-sell your partner bank products and make money! This is the easiest way to generate additional revenue apart from the interchange.

Once you have built enough audience base and insights, you start selling your partner bank products to them. Banks have many products to sell, from savings A/C and personal loans to insurance; you could sell all of them to your cardholders and generate income on a commission basis.

Closing Thoughts

Next-gen financial infrastructure solutions are powering a new fintech paradigm, significantly decreasing the entry barriers which has seen the emergence of new-age card issuers and innovative card programs across the globe, including India. However, from a business perspective, a card program shouldn’t be based just on the interchange revenue-generating model. There are many other ways for the co-brand to make additional revenue, but it requires effort, creativity, and perseverance.

Here’s where Hyperface could empower you to create multiple revenue streams and run an effective card program with a delightful embedded digital experience enabled by easy-to-integrate Smart APIs.

Contact us at business@hyperface.co for a free consultation for launching your own card program, and we’ll help you formulate a 10X powerful co-brand card program.