Why every D2C brand must think of a Co-branded Credit Card driven Loyalty Program

In today’s highly competitive market, customer experience is crucial in purchasing decisions. According to Zendesk’s Customer Experience Trends Report, a staggering 75% of customers base their buying choices on the quality of their experience. This finding puts immense pressure on Direct-to-Consumer (D2C) brands to devise innovative customer engagement and retention strategies.

D2C brands are increasingly turning to co-branded credit card-driven loyalty programs to address this challenge. The 2023 Loyalty Amplifiers Data Study conducted by Ebbo reveals that nearly 80% of consumers express a willingness to make purchases from a brand if they are offered rewards and incentives that can be utilised across multiple brands. It highlights the significant appeal of loyalty programs to foster customer loyalty.

Moreover, research from HBR (Harvard Business Review) highlights that companies with such programs experience revenue growth 2.5 times faster than their competitors.

This blog post explores why every D2C brand must consider embracing a loyalty program empowered by their co-branded credit card.

The Evolution of Loyalty Programs

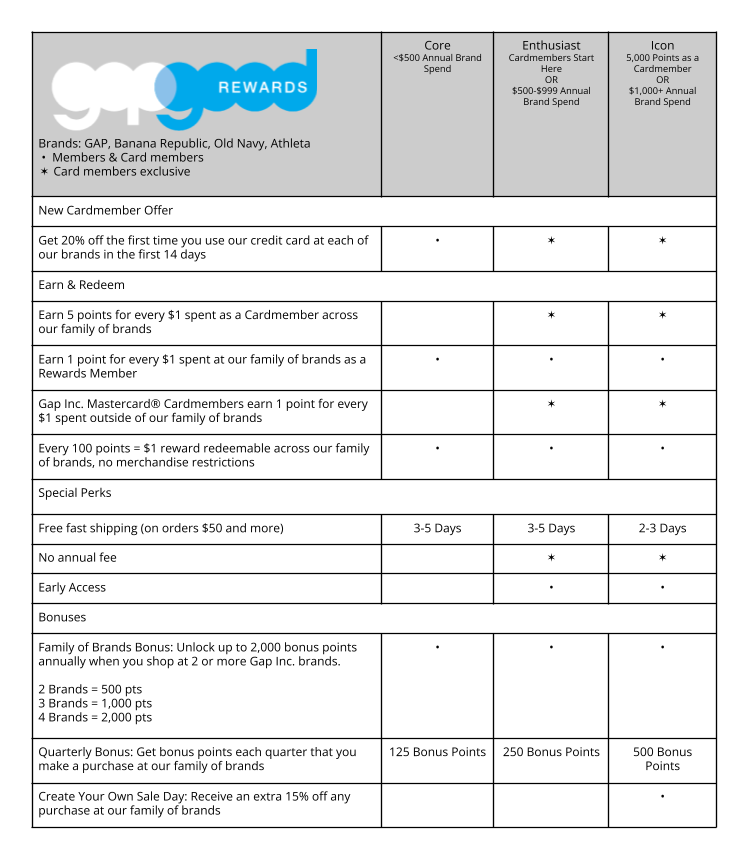

Loyalty programs have evolved remarkably, adapting to changing consumer behaviours and technological advancements. In the past, loyalty programs typically relied on physical punch cards or paper coupons. However, technological advances have paved the way for more sophisticated and personalised loyalty programs. Gap Inc’s Good Rewards Program, linked to their co-branded credit card, is a great example of driving a loyalty program benefits across three membership levels through a credit card.

Benefits and Impact of a Co-branded Credit Card Driven Loyalty Program

The increased perceived value of your loyalty program

A co-branded credit card empowers the brand to offer benefits outside its ecosystem, significantly enhancing the loyalty program’s perceived value. For example, In addition to 5% cashback on Flipkart & Myntra, the Flipkart Axis Bank cardholder also gets 4% cashback for spending at partners like Swiggy, PVR, Uber, Cleartrip, and Curefit.

Run 3rd party offers to add significant value to your loyalty program

A co-branded credit card makes it much easier to partner with third-party brands. It expands the range of rewards available and creates opportunities for cross-promotion and collaboration, ultimately strengthening customer loyalty and attracting new customers to your loyalty program.

Push your customers towards a higher loyalty tier

By offering tier-specific benefits such as enhanced rewards, exclusive access to events, or personalised offers, customers will be encouraged to increase their engagement with your brand, resulting in stronger loyalty and higher spending levels. For example, Axis Bank Vistara credit card holders get complimentary Club Vistara membership, and higher Club Vistara points on spending. A better return of points on the higher tier of club Vistara is an excellent draw for users to spend more on the card.

Increased word of mouth

Satisfied customers who enjoy the benefits and rewards of the program are likely to share their experiences with friends, family, and colleagues, thereby increasing brand awareness and attracting new customers to join the loyalty program. Social media, credit card review sites and influencers can help spread the word about your co-branded credit card offering, positively impacting your brand equity.

Competitive advantage

A customer loyalty program empowered by a co-branded credit card can help D2C brands differentiate themselves from competitors and give customers a solid reason to choose your brand over others. Hence, we see two of the largest e-commerce marketplaces in India having their co-branded credit cards.

Increased frequency of purchase

The combination of rewards, incentives, and exclusive offers motivates customers to engage with your brand regularly, increasing transaction frequency and boosting overall sales and revenue. The Amazon Pay ICICI credit card sees 1.2X spends of the industry average, clearly showing customer interest in repeatedly buying from Amazon.

Enhanced customer experience and engagement

The digital experience of the co-branded credit card can be seamlessly integrated into the D2C brand’s e-commerce platform or mobile app, providing customers with a convenient and streamlined shopping experience. Customers can easily manage their credit cards, view their rewards balance, and redeem rewards directly through the brand’s digital channels. This integration eliminates customers’ need to navigate different platforms, simplifying the process and enhancing the overall experience. On top of this, a quick issuance of the virtual credit card (post bank approval) provides an excellent push for customers to start transacting immediately.

Increased average order value

Co-branded credit card programs often offer rewards and benefits that incentivise customers to spend more. By tying rewards with higher spending thresholds or offering bonus points for specific purchase categories, brands can encourage customers to increase their AOV. For example, the Myntra Kotak Credit Card offers a 7.5% instant discount on all spending across Myntra platforms

Increased brand visibility and brand affinity

Brands can create a visually appealing, unique card design representing their brand identity. The special card design enhances brand visibility and serves as a conversation starter, creating opportunities for cardholders to share their affinity for the brand with others. This ongoing visibility builds brand affinity and fosters a sense of loyalty among cardholders. Collaboration between the bank and the D2C brand allows for joint marketing campaigns, where the brand’s products or services are promoted to the bank’s customer base leading to better brand exposure.

Closing Thoughts

Large D2C brands have realised the importance of backing their loyalty program with a co-branded credit card, and we are seeing a wave of co-branded credit cards launched in India. The proportion of co-branded credit cards has increased from one in ten to one in three new cards issued.

Swiggy, the popular food delivery platform, is gearing up to introduce a co-branded credit card in collaboration with HDFC Bank soon. This initiative follows the footsteps of other prominent players in the market, such as Myntra, Paytm, and Flipkart, who have successfully employed co-branded credit cards as a strategic approach to retain their customer base and enhance their overall revenue.

The Amazon Pay ICICI Bank co-branded credit card which is one of the largest co-branded cards in the country sees faster and higher card activation rate of 70% and higher spending at 1.2X as compared to the industry average as per this report by ICICI Bank.

The data suggest that D2C brands must consider implementing co-branded credit card-driven loyalty programs. These programs cater to customers’ desire for rewards and incentives and prove to be a powerful driver of revenue growth and higher returns. By prioritising the customer experience through such initiatives, D2C brands can position themselves for long-term success in a highly competitive marketplace.

With the Hyperface Credit-Cards-as-a-Service platform, you can quickly build and launch robust co-branded credit card programs that significantly improve customer loyalty and retention. Do drop a line if you’re considering launching a co-branded credit card.

In the next blog, we’ll look at the essential KPIs you should track for your co-branded credit card. Stay tuned!